Position add:

Nine M6AH5 contracts sold at a price of 0.6188.

SL = 0.6296

Total M6AH5 position is now short 31 contracts.

Stop-Loss for the entire position is now at 0.6296.

TMT

Position add:

Nine M6AH5 contracts sold at a price of 0.6188.

SL = 0.6296

Total M6AH5 position is now short 31 contracts.

Stop-Loss for the entire position is now at 0.6296.

TMT

SHORT CAD/USD Mar25

One 6CH5 contract sold at a price of 0.7072

One 6CH5 contract sold at a price of 0.70045

One 6CH5 contract sold at a price of 0.6962

As of 31 Dec 2024, these are my positions:

SHORT Micro AUD/USD Mar25

Seven M6AH5 contracts sold at a price of 0.6367

Eight M6AH5 contracts sold at a price of 0.6309

Seven M6AH5 contracts sold at a price of 0.6245

SHORT Micro EUR/USD Mar25

Four M6EH5 contracts sold at a price of 1.0384

SHORT Micro GBP/USD Mar25

Eight M6BH5 contracts sold at a price of 1.2487

SHORT 5-Year T-Note Mar25

One ZFH5 contract sold at a price of 106.140625

LONG Corn Mar25

One ZCH5 contract bought at a price of 454.50

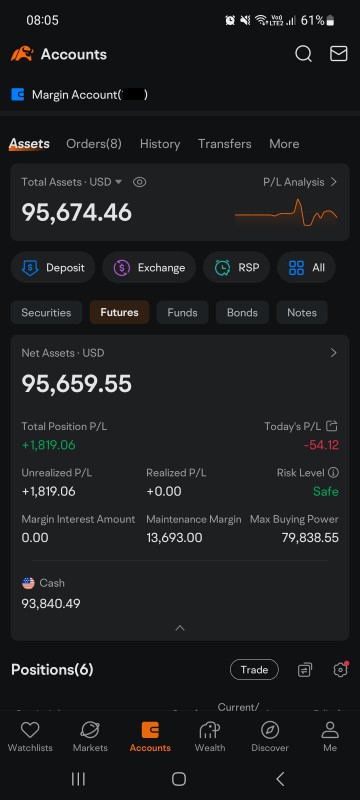

Cash is at 93,840.49 USD. On a NAV basis, I am down 4.4 percent since inception.

To be clear, this is not a sim account. This is real money deposited with the broker.

The choice of trading the micro versus the full contract was not intentional. My broker Moomoo supports trading in micro contract of only certain currencies.

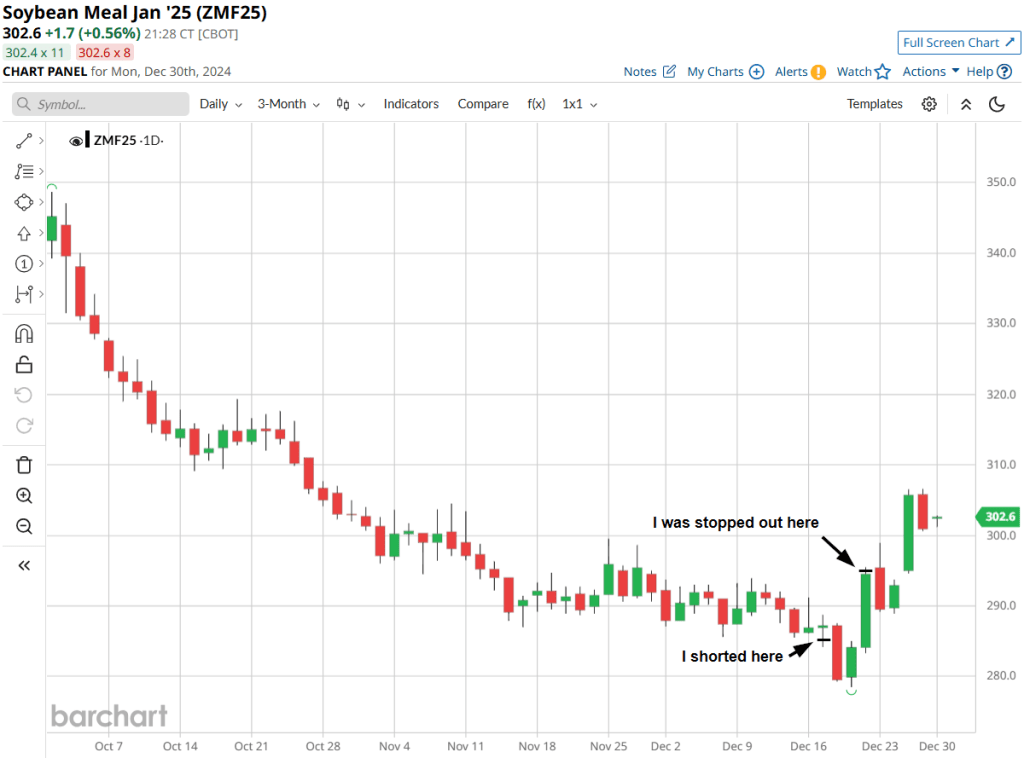

Stop-Losses are imperative. When I put on a trade, I will always put in my stop-loss. I know exactly where I must walk away. The value of this rule was recently demonstrated when I shorted the Soybean Meal Jan25 (ZMF5) at 285.4. The trade was in the money initially. The price then staged a sharp V-shaped rebound. I was stopped out at 295. Were it not for the stop, I would have lost much more money as the price climbed higher.

On the other hand, I do not have a Target Price for each trade. There is no specific risk-to-reward ratio. My system does not tell me to take X dollars of risk for Y dollars of profit. As the open profit increases, I will scale my position, up to the allowable risk limit. The position is to be closed only when the trend reverses.

Did I forget to mention I am a trend follower?

Going into 2025, I will continue this patient and disciplined approach – trade only when there is an entry signal, trade only a risk-adjusted position size, and put in a stop-loss everytime.

I will review the performance again at the end of 2025.

TMT

I am based on the island nation of Singapore. I have a mechanical strategy that I use to trade futures. No news. No fundamentals. No charts. Just numbers.

This is an online journal documenting all of my trades – the wins, the losses and the lessons learnt. I will share more about my current positions in a few days’ time.

The Mechanical Trader aka TMT